Aquaculture Investment Analysis

AquaSol, Inc. continues to work with a broad-base of investment companies with a pre-qualified interest in investing in aquaculture and aquaculture companies seeking new investment or outright sale.

We are continuing to manage and update our proprietary database of private and public aquaculture-related transactions in support of these efforts. Jim Brenner and Tom Frese are the lead consultants on this ongoing initiative.

In 2018, AquaSol, Inc. will publish a fee-based report on aquaculture transactions and valuation of aquaculture companies.

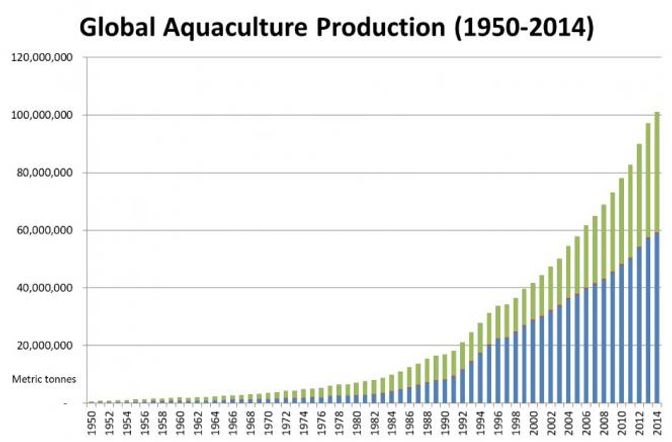

Global aquaculture production has grown steadily since the 1950s, accelerating sharply from the 1990s onwards as fish farming became a major contributor to global seafood supply. By 2014, aquaculture output had reached around 100 million metric tonnes, highlighting its critical role in meeting rising global demand for protein.

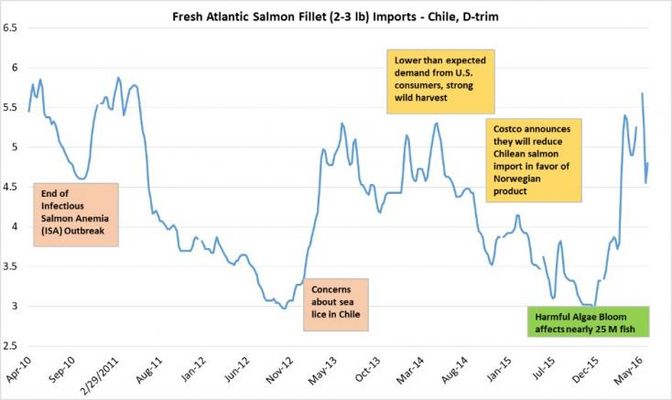

Prices for fresh Atlantic salmon fillets from Chile show significant volatility over time, driven by disease outbreaks, environmental events, and shifting market demand. The chart highlights how biological risks and retail sourcing decisions can rapidly impact salmon prices in global markets.

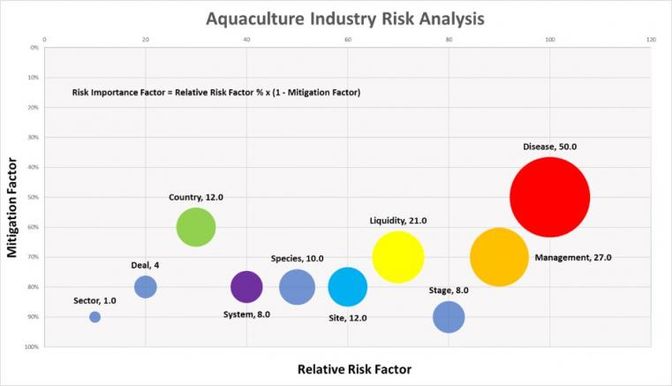

This risk analysis shows that disease and management represent the most significant unmitigated risks in aquaculture, combining high impact with limited mitigation effectiveness. In contrast, factors such as sector, deal structure, and system design carry lower relative risk or are more easily mitigated.